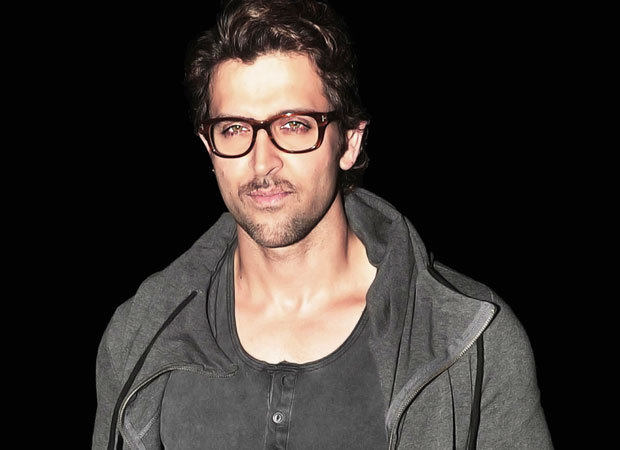

The Mumbai bench of Income Tax Appellate Tribunal (ITAT) recently ruled that it was not an actor's responsibility or obligation to incur the expenditure on the film’s promotions. This was with respect to Hrithik Roshan’s tax deduction claim in lieu of his expenditure of Rs 5.6 lakh (in 2010-11) that had incurred for the promotion of his film Guzaarish.

ITAT declares money spent by Hrithik Roshan for Guzaarish’s promotions is taxableAn income tax officer, while verifying Hrithik Roshan's IT (Income Tax) returns, found out that the actor had shown an ‘expenditure’ of Rs 7 lakh spent for the promotions of his film Guzaarish. Hrithik Roshan had said that the said amount was paid to seven contestants of ‘Sa Re Ga Ma Pa’. The aforementioned IT officer, while disallowing Hrithik Roshan’s expenditure claim in his IT computation as a ‘business deduction’, clarified that it was the producer's responsibility to own the expenditures relating to film's making and promotions.

ITAT, on its part, observed that the contract’s terms did not need Hrithik Roshan to bear any kind of expenditure (for the film’s promotions), nor there was any contract with the TV channel. In view of Hrithik Roshan gifting cash prizes to the contestants, ITAT said that, if he (Hrithik Roshan) decided to give cash gifts to participants for encouraging them, it was a voluntary and spontaneous act, and had nothing to do with film’s promotion in any way. That’s the reason why, on November 18, the ITAT had upheld the IT official's action.

On the other hand, Hrithik Roshan was definitely given some concession by the ITAT in the form of the dismissal of arbitrary approach of the official for computing annual value of two vacant premises owned by him at Lotus Business Park. Secondly, ITAT had accepted that Hrithik Roshan had not incurred expenditure for earning tax-free income, such as equity dividend and interest on RBI relief bonds. That’s why it deleted an addition of Rs 6.3 lakh to the taxable income made by the officer during the Income Tax assessment.

BOLLYWOOD NEWS - LIVE UPDATES

Catch us for latest Bollywood News, New Bollywood Movies update, Box office collection, New Movies Release , Bollywood News Hindi, Entertainment News, Bollywood Live News Today & Upcoming Movies 2024 and stay updated with latest hindi movies only on Bollywood Hungama.